How Company Performance Is Scored

The scoring procedure is tied to how well each BSG company isable to meet or beat the 5 performance targets which board membershave set for the company’s management team:

Grow earnings per share from $2.00 at the end of Year 10 to$2.50 in Year 11, $3.00 in Year 12, $3.50 in Year 13, $4.00 in Year14, $4.50 in Year 15, $5.25 in Year 16, $6.00 in Year 17, $7.00 inYear 18, $8.50 in Year 19, and $10.00 in Year 20.Grow average return on equity investment (ROE) from 20% at theend of Year 10 to 21% in Year 11 and by an additional 1% annuallyin Years 12 through 20 (thus reaching 30% in Year 20). Average ROEis defined as net income divided by the average of totalshareholder equity balance at the beginning of the year and the endof the year. Average ROE for each company is reported on page 2 ofthe Footwear Industry Report. The formula for calculating yourcompany’s average ROE appears in Note 11 on page 7 of the CompanyOperating Reports below the Balance Sheet.Achieve stock price gains from $30 at the end of Year 10 to $40in Year 11, $50 in Year 12, $65 in Year 13, $80 in Year 14, $100 inYear 15, $125 in Year 16, $150 in Year 17, $180 in Year 18, $215 inYear 19, and $250 in Year 20. Board members agree that such stockprice gains are within reach if the company meets or beats theannual EPS targets, from time to time pays a higher dividend toshareholders, and perhaps repurchases some of the common stockshares outstanding. Your company’s stock price is a function ofrevenue growth, earnings per share growth, ROE, credit rating,dividend per share growth, and management’s ability to consistentlydeliver good results as measured by the percentage of the 5performance targets that your company achieves over the course ofthe BSG exercise.Achieve a credit rating of B+ or higher in Years 11-13, A- orhigher in Years 14 through Year 16, and at least A in Years 17through Year 20. The company’s credit rating was B at the end ofYear 10.Achieve an “image rating” of 70 or higher in Year 11, 72 inYears 12-13, 75 in Years 14-15, 77 in Years 16-17, and 80 in Years18-20. The image rating is based on: (1) the company’s branded S/Qratings in each geographic region, (2) the company’s global marketshares for both branded and private-label footwear (as determinedby their market shares in the four geographic regions), and (3) thecompany’s efforts in Corporate Social Responsibility andCitizenship over the past 4-5 years.The default weights placed on the five performance targetsare 20% each. The five weights translate into 20 points outof 100 for each of the 5 performance measures, with the sum of thepoints adding to a total of 100 points. There is an option on yourAdministrative Menu for each “industry” that allows you to alterthese weights however you see fit. The scoring weights selected arereported to all company co-managers in the narratives at the bottompage 1 of the Footwear Industry Report and also in the narrativesshowing the company scores on each scoring variable on pages 2 and3 of the Footwear Industry Report. Hence, class members will bewell aware of what the weights are.

Using the assigned weights (or corresponding number of pointsout of 100), each company’s performance on the 5 measures istracked annually and company performance scores are calculated fromtwo different angles: the “investor expectations”standard and the “best-in-industry”standard.

Special Note:The scoring procedures describedbelow may seem more complicated than they really are because we areproviding full details and explanations of how the scoringworks—in truth a company’s overall performance cannot befairly or accurately gauged by “keeping it simple” and looking atjust a couple of performance measures. A “balancedscorecard” for determining how well a company is doing financiallyand strategically has to be multi-faceted and somewhatsophisticated in order to look at a company’s performance fromseveral perspectives and angles.

The BSG scoring methodology, introduced in 2004 and now used forover 500,000 participants, has an exceptionally good, time-testedtrack record. The scoring synopsis provided on the scoreboard pages(pages 1, 2, and 3) of the Footwear Industry Report is verydetailed and complete. The tutorial videos associated with thefirst three pages of the Footwear Industry Report attempt toexplain the scoring in a more succinct and fundamental manner.

The Investor Expectations (I.E.) ScoringStandard. The Investor Expectations Standard involvescalculating an annual “Investor Expectation Score” based on acompany’s success in meeting or beating the five investor-expectedperformance targets each year. There is also a Game-to-Date or“all-years” Investor Expectation Score that shows a company’ssuccess in achieving or exceeding the expected performance targetsover all years of the exercise completed so far. Some importantaspects of how the Investor Expectation (I.E.) Scores arecalculated are summarized below:

Meeting each expected performance target is worth some numberof points based on the scoring weight you select (the defaultscoring weights—which we recommend using—are 20% or 20-pointseach). For instance, if the scoring weight for EPS (or ROE or stockprice or image rating or credit rating) is 20%, meeting the EPS (orROE or stock price or image rating or credit rating) target earns ascore of 20 on each particular performance measure.Beating the EPS, ROE, stock price, and/or image rating targetsis worth additional points equal to 0.5% for each 1.0% that acompany’s actual performance exceeds the expected performance forEPS, ROE, stock price, and image rating, up to a maximum 20%additional for each measure. For example, if a company achieves anEPS of $6.00 when the target is $4.00 and if EPS carries a 20-pointweighting, then the company will receive an EPS score of 24(because it beat the target by 50% and qualifies for the maximum20% additional points over the 20-points awarded for just matchingthe EPS target). Additional points are also awarded for creditratings that exceed the targets, with a full 20% additional beinggiven for an A+ rating.Failure to achieve the investor-expected target for EPS or ROEor stock price or image rating results in a score for thatperformance measure between 0 and the point maximum for thatmeasure, with the score depending on the percentage of the targetachieved. For instance, if a company achieves a stock price of $20at a time when the stock price target is $50, then the company’sscore on the stock price target (assuming a 20% weight and thus 20possible points) would be 8 points (40% of the 20 points awardedfor meeting the stock price target).If a company’s EPS is negative, no points are awarded towardmeeting investor expectations for EPS.If in a given year a company has a negative ROE, no points areawarded on the ROE measure.If the point weighting for credit rating is 20 (which equatesto a maximum of 24 points including the bonus), then the variouspossible credit rating scores are as follows:Credit RatingYear 11 – Year 13Year 14 – Year 16Year 17 – Year 20A+24 points24 points24 pointsA23 points22 points20 pointsA–22 points20 points18 pointsB+20 points18 points16 pointsB16 points15 points14 pointsB–12 points12 points11 pointsC+8 points8 points8 pointsC4 points4 points4 pointsC–0 points0 points0 pointsThe sum of a company’s scores on each of the 5investor-expected targets equals its annual I.E. Score. Exactlymeeting each of the 5 performance targets produces an I.E. Score of100. Beating the EPS, ROE, stock price, and image rating targets by20% or more and earning an A+ credit rating results in a maximumachievable I.E. Score of 120.A company’s Game-to-Date Investor Expectation Score isdetermined as summarized below:Game-to-Date I.E. Scoring for EPS is based on howeach company’s weighted-average EPS for all years completedcompares to the average of the EPS targets for all years completed.Companies that meet the all-year weighted-average EPS targetreceive a score equal to the EPS point weighting. Companies thatbeat the weighted-average EPS target receive additional points ofup to 20%, and companies that fall short of the weighted-averageEPS target receive scores equal to the fraction of the EPS targetthat was achieved. More details are provided in the Help documentfor Page 2 of the Footwear Industry Report.Game-to-Date I.E. Scoring for ROE is based on howeach company’s weighted-average ROE for all years completedcompares to the average of the ROE targets for all years completed.Companies that meet the all-year weighted-average ROE targetreceive a score equal to the ROE point weighting. Companies thatbeat the weighted-average ROE target receive additional points ofup to 20%, and companies that fall short of the weighted-averageEPS target receive scores equal to the fraction of the ROE targetthat was achieved. More details are provided in the Help documentfor Page 2 of the Footwear Industry Report.Game-to-Date I.E. Scoring for Stock Price isbased only on each company’s most recent year’s stockprice, not on an average. The latest stock prices are usedfor game-to-date scoring because a company’s latest stock price isa function of EPS growth, ROE, credit rating, dividend per sharegrowth, and management’s ability to consistently deliver goodresults, and thus includes a heavy long-term element. Companiesthat meet the most recent year’s stock price target receive a scoreequal to the stock price point weighting; companies that beat themost recent year’s stock price target receive additional points ofup to 20%, and companies that fall short of the most recent year’sstock price target receive scores equal to the fraction of thestock price target that was achieved. More details are provided onthe Help document for Page 2 of the Footwear Industry Report.Game-to-Date I.E. Scoring for Credit Rating isbased only on each company’s most recent year’s creditrating, not on an average.. Only the latest year’s creditrating is used to measure the game-to-date credit rating scorebecause a company’s latest credit rating is largely reflective ofits long-term financial condition and the overall balance sheetstrength that management has engineered to date. The game-to-dateI.E. scores for credit rating are always the same as for thecurrent-year scores because both are based on the most recentyear’s credit rating. More details about the credit rating scoringare provided on the Help document for Page 3 of the FootwearIndustry Report.Game-to-Date I.E. Scoring for Image Rating isbased on how each company’s average image rating for the mostrecent three years compares to the average target for themost recent three years. A 3-year average image rating is used tomeasure game-to-date performance so as not to burden a company’sperformance by image ratings that are not representative of theimage and reputation it has recently achieved with its strategy.Companies whose average image rating for the most recent 3 yearsequals the 3-year average image rating target receive a score equalto the image rating point weighting. Companies with 3-year averageimage ratings above the 3-year average target receive additionalpoints of up to 20%. And companies with 3-year average imageratings below the 3-year average target receive scores equal to thefraction of the image rating target that was achieved. More detailsare provided on the Help document for Page 3 of the FootwearIndustry Report.The sum of a company’s Game-to-Date scores on each of the fivescoring measures equals its total Game-to-Date I.E. Score.The Game-to-Date I.E. scores are therefore NOT equal to anaverage of the annual I.E. scores.Both annual and Game-to-Date Scores of 100 to 120 are quiteexcellent, scores of 90-99 are very good, scores of 80-89 are good,scores of 70-79 are fair, and scores below 70 reflect consistently“sub-par” results in meeting the targets that investors expect andthat company Board of Directors set for management to achieve.The Best-in-Industry (B-I-I) ScoringStandard. The Best-In-Industry or B-I-I standard concernshow well each company performs relative to the “best-in industry”performer on 4 measures—EPS, ROE, image rating, and stock price andhow close each company comes to the ultimate credit rating of A+.Again, the performance scores are based on the weights/pointsassigned to each of the 5 performance measures, with the sum of thepoints on the 5 measures adding to 100. The Best-In-Industrystandard entails assigning the best-performing company the highestnumber of points and then assigning each remaining company a lessernumber of points according to what percentage of the leader’sperformance they were able to achieve. For instance, if ROE isgiven a weight of 20% (20 points), an industry-leading ROEperformance of 25% gets a score of 20 points and a company with anROE of 20% (which is 80% as good as the leader’s 25%) gets a scoreof 16 points (80% of 20 points)—the B-I-I scores for EPS, stockprice and image rating work in precisely the same manner. Theprocedure is slightly different for the credit rating measure—eachcredit rating grade is tied to the number of points you assign tocredit rating (an A+ rating always gets a Best-In-Industry scoreequal to the instructor-chosen maximum, with the scores for lowercredit ratings scaled down all the way to 0 for a C rating).

Each company’s Best-In-Industry (B-I-I) score is equal toits combined point total on the five performance measures.In order to receive a score of 100, a company must (1) be thebest-in-industry performer on EPS, ROE, stock price, and imagerating, (2) achieve the targets for EPS, ROE, stock price and imagerating set by the company’s Board of Directors, and (3) have an A+credit rating. B-I-I scores of 80 to 100 reflect good-to-excellentperformance; scores under 50 should cause company co-managers greatconcern and signal the need for immediate strategy improvement.

Below are some important aspects of how the Best-In-Industryscores for a given year are calculated:

The Best-In-Industry scoring standard is based on a maximumscore of 100 points, with each scoring variable carrying a 20-pointrating (unless you alter the 20% default weights). To get a scoreof 100, a company has to be the highest performing company—termedthe best-in-industry performer—on all five performance measuresduring the year, meet or beat the EPS, ROE, stock price, and imagerating targets for that year, and have an A+ credit rating.The best-in-industry performer on each measure earns a perfectscore (the full number of points based on the chosen pointweightings—provided the industry leader’s performance on thatmeasure equals or exceeds the annual performance target establishedby company Boards of Directors). Each remaining company earns afraction of the points earned by the best-in-industry performerthat is equal to its performance (on EPS, ROE, stock price, andimage rating) divided by the performance of the industry-leadingcompany (on EPS, ROE, stock price, and image rating). For instance,if ROE is given a weight of 20 points, an industry-leading ROEperformance of 25% gets a score of 20 points (provided the annualROE target is not greater than 25%) and a company with an ROE of20% (which is 80% as good as the leader’s 25%) gets a score of 16points (80% of 20 points).If the best-in-industry performer’s EPS, ROE, stock price, orimage rating is below the performance target for that year, theindustry-leading company is not awarded a perfect score (themaximum number of points) but rather a percentage of the maximumscore that equals the leader’s EPS, ROE, stock price, or imagerating as a % of the corresponding performance target for thatyear. This is done to prevent a company with the highest averageEPS, ROE, stock price, or image rating from being awarded a highBest-in-Industry score when its performance on EPS, ROE, stockprice or image rating actually falls below target performancelevels. In all such instances, each remaining company will earn afraction of the points earned by the best-in-industry performer,with that fraction being equal to its performance (on EPS, ROE,stock price, and image rating) divided by the performance of theindustry-leading company.The procedure for assigning Best-In-Industry scores is a bitdifferent for the credit rating measure. Each credit rating gradefrom A+ to C carries a certain number of points that scales downfrom the maximum number of points for an A+ credit rating to 1pointfor a C rating. If the credit rating weight is 20 points out of100, the B-I-I point awards for credit rating are as follows:Credit RatingScoreA+20 pointsA19 pointsA–18 pointsB+16 pointsB14 pointsB–11 pointsC+8 pointsC5 pointsC–1 pointAll companies that lose money in any given year and end up witha negative EPS automatically receive a Best-In-Industry EPS scoreof 0 points.Similarly, companies with a negative ROE have aBest-In-Industry ROE score of 0 points.Each company’s B-I-I score equals its combined point total onthe five performance measures.Best-In-Industry performance scores of 90-99 are excellent,scores of 80-89 are good to very good, scores of 70-79 are fair togood, scores of 60-69 are weak to fair, and scores below 60 reflecta performance roughly 40% or more below that of companies withscores in the 90s—which says that such companies were outperformedby other companies in the industry by a significant margin.

The highest possible Best-in-Industry (B-I-I) Score is 100,earned only if a company is the best performer on EPS (with an EPSequal to or above the target), the best performer on ROE (with anROE equal to or above the target), the best performer on stockprice (with a stock price equal to or above the yearly target), andthe best performer on image rating (with an image rating equal toor above the yearly target) and also has an A+ credit rating.

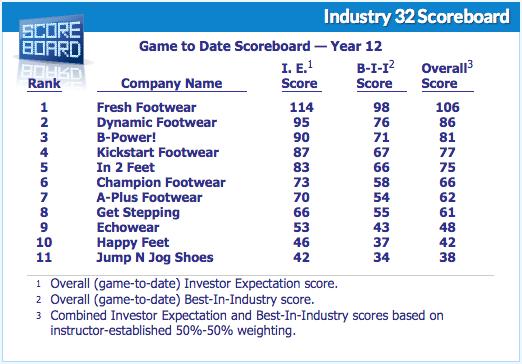

Combining the Annual and Game-to-DateScores into Overall Scores. The scoring includes both anannual and a game-to-date “Overall Score” for each company. Thesescores are determined by combining each company’s InvestorExpectation Score and the Best-in-Industry Score into a singlescore using whatever weighting you wish (the defaultweighting—which we strongly recommend—is 50% each). The AnnualOverall Scores for the various companies are a weighted average oftheir respective annual I.E. scores and the annual B-I-I scores,while the Game-to-Date Overall Scores are a weighted average of thegame-to-date I.E. scores and the game-to-date B-I-I scores.

Since I.E. scores can range as high as 120, it is common for theOverall Scores of the very best-performing companies to be greaterthan 100. Overall Scores that are greater than 100 are clearlyindicative of superior company performance. As a general rule, wethink that companies with an overall performance score of 90 orabove at the conclusion of the simulation should receive a gradefrom A– to A+ on this portion of the BSG exercise. Companies withoverall game-to-date scores of 80-89 should get a B– to a B+ (orhigher if there are no companies with scores of 90 or more).Companies with an overall performance score of 70-79 above shouldget a grade in the C range (or higher depending on how manycompanies have higher scores). You may find it desirable to scalethe company grades if competition turns out to be so fierce orcutthroat that companies in the industry can’t earn profits thatmeet investors’ performance expectations and thus end up with “low”overall game-to-date scores. In most of our classes, we end upscaling the performance scores of companies with overall scoresbelow 70, but there is usually at least one company with a scoreabove 90 (clearly meriting an A),so scaling scores on the upper endof the industry rankings is typically unnecessary.

A game-to-date scoreboard appears on the Administration page foreach “industry” you have created in your instructor account, and ascoreboard containing the same information is displayed on eachcompany’s Corporate Lobby page. After each decision round, studentsand instructors can view or print the Footwear Industry Report,pages 1-3 showing each company’s performance on every aspect of thescoring, including all the scoring weights. The associated Helpdocuments provide detailed explanations of the scoring, so studentsshould encounter no “mystery” factor about how the scoring works orwhere each company stands in the industry performance rankings.

The Optional Bonus Point Feature.Every decision round, companies have the opportunity to qualify fortwo special bonus point awards that can increase their company’soverall game-to-date score. Both bonus awards are a part of thesimulation scoreboard, are calculated and awarded automatically toqualifying companies, and shown as an addition or adjustment to acompany’s overall score. The two bonus point awards are:

The Bull’s Eye Award (awarded annually for accuratelyprojecting company performance) — One bonus point is added to acompany’s game-to-date score when (1) the company’s actual totalrevenues are within ±5% of projected total revenues, (2) thecompany’s actual EPS is within 10¢ or ±5% of projected EPS, and (3)the company’s actual image rating is within ±4 points of theprojected image rating. To qualify for the Bull’s Eye Awardin a given year a company must achieve ALL of the aboverequirements for that year.Standard rounding rules apply to the ±5% calculations forrevenues and EPS. There are no decimal points involved in thecalculation and reporting of a company’s Image Rating.Partial bonus points are NOT awarded when just one or two ofthese three conditions are met.All companies that meet all three conditions in a given yearare awarded 1 Bull’s Eye bonus point for that year.There is no limit on the number of Bull’s Eye Awards a givencompany can receive over the course of the simulation. So receivinga Bull’s Eye Award for each decision round can significantly impacta company’s overall score.While Bull’s Eye Award statistics are provided during thepractice rounds for illustrative purposes, any awards earned duringthe practice rounds are erased when the Data Reset occurs—in otherwords, any Bull’s Eye Awards during the practice rounds “do notcount” and will not be included in the bonus-point additions to acompany’s final game-to-date score.The total bonus points accumulated by each company and thebonus-point-adjusted overall score for each company are shown inthe center section of page 1 of the Footwear Industry Report wherethe Overall Game-to-Date company scores appear.The Leap Frog Award (awarded annually for most improvedoverall current-year performance score) — Beginning in Year 12, onebonus point is added to a company’s overall game-to-date score whenthe company’s current-year score shows the biggest improvement overits current score for the prior year (based on number of points,rather than percentage improvement) in comparison to the scoregains of all other companies in the industry.The first Leap Frog Award is given in Year 12 (since it takestwo years of results for a company to show improvement over itsprior year’s results).In case two or more companies tie for the biggestpoint-improvement in overall current-year score, each company willreceive a 1-point Leapfrog Award bonus.In the rare instance where all companies fail to improve theircurrent scores from one year to the next (indicated by a negativeyear-to-year change in overall score for all companies in theindustry), a Leap Frog bonus is not awarded.The total bonus points accumulated by each company and thebonus-point-adjusted overall score (including both Bull’s Eye andLeap Frog bonuses) are shown in the bottom section of page 1 of theFootwear Industry Report where the Overall Game-to-Date companyscores appear.The Bull’s Eye and Leap Frog awards accomplish three worthwhilepurposes:

Provide an additional element of interest and excitement forstudents/participants when the performance outcomes are generatedas the deadline for each decision-making round passes.Encourage students to put more thought and analysis into makingaccurate projections of upcoming-year outcomes and searching for astrategy and decision combination with the most realistic chance ofproducing good year-over-year overall improvement (just as occursin real-world companies). Students will certainly appreciate beingrewarded when their efforts to accurately anticipate theircompany’s performance or to achieve a bigger jump in overall scorethan rival companies are successful.Give company-teams an opportunity to enhance their overallscore via measures outside the five standard simulation scoringvariables (EPS, ROE, Stock Price, Credit Rating, and Image Rating).This may serve as an additional incentive for companies notcurrently challenging for the industry lead.There is a page in the Footwear Industry Report (page 3b)devoted exclusively to reporting the bonus points awarded to allcompanies across all the decision rounds—the associated Helpdocument provide students with detailed explanations of how theBonus Point awards are calculated.

By default, the optional Bonus Point Scoring feature isenabled when you set up the simulation exercise for yourclass. However, if you wish, you can disable the bonuspoint feature by un-checking the Bonus Awards box that appears inthe Company Performance Grade Book (which is accessed from yourAdministration Menu). We strongly urge that you utilize the bonuspoint scoring feature at least initially—even if you are skepticalabout its value.

The Default Scoring Weights. The“default weights” for the five performance measures on which eachcompany is scored were set at 20% each because a 20% weight foreach of the five variables constitutes a “balanced scorecard” thatis in reasonably close accord with judging the performance ofreal-world companies. However, you can alter these weights if youwish—see the Grade Books and Scoring heading in the AdministrationMenu, Scoring Weights menu item.

The 50%-50% Default Weights for the TwoScoring Standards. As explained above, the default weightsfor the 2 scoring standards in The Business Strategy Game are 50%for the Investor Expectations Standard and 50% for theBest-In-Industry Standard. The default weighting is recommended,but you can change the weights if you wish—see the Grade Books andScoring heading in the Administration Menu, Company PerformanceGrade Book menu item.

If the scoring standard weights are changes the weighted averageperformance scores in your Company Performance Grade Book will berecalculated. Also, the Overall Scores in the Scoreboard box onyour Industry Menu page and on each company’s Corporate Lobby pagewill immediately reflect the new weights.

Concluding Comments aboutScoring. One very important point about the BSG scoringmethodology warrants emphasis: it is a company’s overallscore that matters (how close company scores are to 100-120in the case of the Investor Expectations Standard and how closethey are to 100 in the case of the Best-in-Industry Standard), notwhether a company is in first or last place. There willalways be a last place company, but what is truly telling iswhether it is in last place with a score of 85 (which clearlysignals a strong performance and a deservedly good grade) or inlast place with a score of 37 (which clearly signals a poorperformance and a deservedly lesser grade).