Game theory, the study of strategic decision-making, brings together disparate disciplines such as mathematics, psychology, and philosophy. Game theory was invented by John von Neumann and Oskar Morgenstern in 1944 and has come a long way since then. The importance of game theory to modern analysis and decision-making can be gauged by the fact that since 1970, as many as 12 leading economists and scientists have been awarded the Nobel Prize in Economic Sciences for their contributions to game theory.

Game theory is applied in a number of fields, including business, finance, economics, political science, and psychology. Understanding game theory strategies—both the popular ones and some of the relatively lesser-known stratagems—is important to enhance one’s reasoning and decision-making skills in a complex world.

Key Takeaways

Game theory is a framework for understanding choice in situations among competing players.Game theory can help players reach optimal decision-making when confronted by independent and competing actors in a strategic setting.A common "game" form that appears in economic and business situations is the prisoner's dilemma, where individual decisionmakers always have an incentive to choose in a way that creates a less than optimal outcome for the individuals as a group.Several other forms of game exist. The practical application of these games can be a valuable tool to aid in the analysis of industries, sectors, markets, and any strategic interaction between two or more actors.Prisoner’s Dilemma

One of the most popular and basic game theory strategies is the prisoner's dilemma. This concept explores the decision-making strategy taken by two individuals who, by acting in their own individual best interest, end up with worse outcomes than if they had cooperated with each other in the first place.

In the prisoner’s dilemma, two suspects apprehended for a crime are held in separate rooms and cannot communicate with each other. The prosecutor informs both Suspect 1 and Suspect 2 individually that if he confesses and testifies against the other, he can go free, but if he does not cooperate and the other suspect does, he will be sentenced to three years in prison. If both confess, they will get a two-year sentence, and if neither confesses, they will be sentenced to one year in prison.

While cooperation is the best strategy for the two suspects, when confronted with such a dilemma, research shows most rational people prefer to confess and testify against the other person than stay silent and take the chance the other party confesses.

It is assumed players within the game are rational and will strive to maximize their payoffs in the game.

The prisoner's dilemma lays the foundation for advanced game theory strategies, of which the popular ones include:

Matching Pennies

This is a zero-sum game that involves two players (call them Player A and Player B) simultaneously placing a penny on the table, with the payoff depending on whether the pennies match. If both pennies are heads or tails, Player A wins and keeps Player B’s penny. If they do not match, Player B wins and keeps Player A’s penny.

Deadlock

This is a social dilemma scenario like the prisoner’s dilemma in that two players can either cooperate or defect (i.e. not cooperate). In a deadlock, if Player A and Player B both cooperate, they each get a payoff of 1, and if they both defect, they each get a payoff of 2. But if Player A cooperates and Player B defects, then A gets a payoff of 0 and B gets a payoff of 3. In the payoff diagram below, the first numeral in the cells (a) through (d) represents Player A’s payoff, and the second numeral is that of Player B:

Deadlock Payoff Matrix Player BPlayer BCooperateDefectPlayer ACooperate(a) 1, 1(b) 0, 3 Defect(c) 3, 0(d) 2, 2Deadlock differs from a prisoner’s dilemma in that the action of greatest mutual benefit (i.e. both defect) is also the dominant strategy. A dominant strategy for a player is defined as one that produces the highest payoff of any available strategy, regardless of the strategies employed by the other players.

A commonly cited example of deadlock is that of two nuclear powers trying to reach an agreement to eliminate their arsenals of nuclear bombs. In this case, cooperation implies adhering to the agreement, while defection means secretly reneging on the agreement and retaining the nuclear arsenal. The best outcome for either nation, unfortunately, is to renege on the agreement and retain the nuclear option while the other nation eliminates its arsenal since this will give the former a tremendous hidden advantage over the latter if war ever breaks out between the two. The second-best option is for both to defect or not cooperate since this retains their status as nuclear powers.

Cournot Competition

This model is also conceptually similar to the prisoner’s dilemma and is named after French mathematician Augustin Cournot, who introduced it in 1838. The most common application of the Cournot model is in describing a duopoly or two main producers in a market.

For example, assume companies A and B produce an identical product and can produce high or low quantities. If they both cooperate and agree to produce at low levels, then limited supply will translate into a high price for the product on the market and substantial profits for both companies. On the other hand, if they defect and produce at high levels, the market will be swamped and result in a low price for the product and consequently lower profits for both. But if one cooperates (i.e. produces at low levels) and the other defects (i.e. surreptitiously produces at high levels), then the former just break even while the latter earns a higher profit than if they both cooperate.

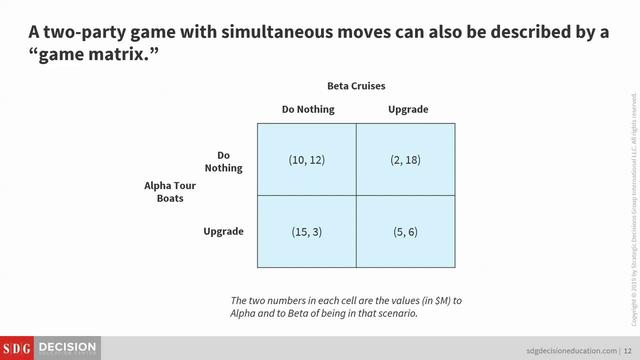

The payoff matrix for companies A and B is shown (figures represent profit in millions of dollars). Thus, if A cooperates and produces at low levels while B defects and produces at high levels, the payoff is as shown in the cell (b)—break-even for company A and $7 million in profits for company B.

Cournot Payoff Matrix Company BCompany BCooperateDefectCompany ACooperate(a) 4, 4(b) 0, 7 Defect(c) 7, 0(d) 2, 2Coordination Game

In coordination, players earn higher payoffs when they select the same course of action.

As an example, consider two technology giants who are deciding between introducing a radical new technology in memory chips that could earn them hundreds of millions in profits, or a revised version of an older technology that would earn them much less. If only one company decides to go ahead with the new technology, rate of adoption by consumers would be significantly lower, and as a result, it would earn less than if both companies decide on the same course of action. The payoff matrix is shown below (figures represent profit in millions of dollars).

Thus, if both companies decide to introduce the new technology, they would earn $600 million apiece, while introducing a revised version of the older technology would earn them $300 million each, as shown in the cell (d). But if Company A decides alone to introduce the new technology, it would only earn $150 million, even though Company B would earn $0 (presumably because consumers may not be willing to pay for its now-obsolete technology). In this case, it makes sense for both companies to work together rather than on their own.

Coordination Playoff Matrix Company BCompany BNew TechnologyOld TechnologyCompany ANew Technology(a) 600, 600(b) 0, 150 Old Technology(c) 150, 0(d) 300, 300Centipede Game

This is an extensive-form game in which two players alternately get a chance to take the larger share of a slowly increasing money stash. The centipede game is sequential since the players make their moves one after another rather than simultaneously; each player also knows the strategies chosen by the players who played before them. The game concludes as soon as a player takes the stash, with that player getting the larger portion and the other player getting the smaller portion.

As an example, assume Player A goes first and has to decide if he should “take” or “pass” the stash, which currently amounts to $2. If he takes, then A and B get $1 each, but if A passes, the decision to take or pass now has to be made by Player B. If B takes, she gets $3 (i.e. the previous stash of $2 + $1) and A gets $0. But if B passes, A now gets to decide whether to take or pass, and so on. If both players always choose to pass, they each receive a payoff of $100 at the end of the game.

The point of the game is if A and B both cooperate and continue to pass until the end of the game, they get the maximum payout of $100 each. But if they distrust the other player and expect them to “take” at the first opportunity, Nash equilibrium predicts the players will take the lowest possible claim ($1 in this case). Experimental studies have shown, however, this “rational” behavior (as predicted by game theory) is seldom exhibited in real life. This is not intuitively surprising given the tiny size of the initial payout in relation to the final one. Similar behavior by experimental subjects has also been exhibited in the traveler’s dilemma.

Traveler’s Dilemma

This non-zero-sum game, in which both players attempt to maximize their own payout without regard to the other, was devised by economist Kaushik Basu in 1994. For example, in the traveler’s dilemma, an airline agrees to pay two travelers compensation for damages to identical items. However, the two travelers are separately required to estimate the value of the item, with a minimum of $2 and a maximum of $100. If both write down the same value, the airline will reimburse each of them that amount. But if the values differ, the airline will pay them the lower value, with a bonus of $2 for the traveler who wrote down this lower value and a penalty of $2 for the traveler who wrote down the higher value.

The Nash equilibrium level, based on backward induction, is $2 in this scenario. But as in the centipede game, laboratory experiments consistently demonstrate most participants, naively or otherwise, pick a number much higher than $2.

Traveler’s dilemma can be applied to analyze a variety of real-life situations. The process of backward induction, for example, can help explain how two companies engaged in a cutthroat competition can steadily ratchet product prices lower in a bid to gain market share, which may result in them incurring increasingly greater losses in the process.

Battle of the Sexes

This is another form of the coordination game described earlier, but with some payoff asymmetries. It essentially involves a couple trying to coordinate their evening out. While they had agreed to meet at either the ball game (the man’s preference) or at a play (the woman’s preference), they have forgotten what they decided, and to compound, the problem, cannot communicate with one another. Where should they go? The payoff matrix is shown below with the numerals in the cells representing the relative degree of enjoyment of the event for the woman and man, respectively. For example, cell (a) represents the payoff (in terms of enjoyment levels) for the woman and man at the play (she enjoys it much more than he does). Cell (d) is the payoff if both make it to the ball game (he enjoys it more than she does). Cell (c) represents the dissatisfaction if both go not only to the wrong location but also to the event they enjoy least—the woman to the ball game and the man to the play.

Battle of the Sexes Payoff Matrix ManManPlayBall GameWomanPlay(a) 6, 3(b) 2, 2 Ball Game(c) 0, 0(d) 3, 6Dictator Game

This is a simple game in which Player A must decide how to split a cash prize with Player B, who has no input into Player A’s decision. While this is not a game theory strategy per se, it does provide some interesting insights into people’s behavior. Experiments reveal about 50% keep all the money to themselves, 5% split it equally and the other 45% give the other participant a smaller share. The dictator game is closely related to the ultimatum game, in which Player A is given a set amount of money, part of which has to be given to Player B, who can accept or reject the amount given. The catch is if the second player rejects the amount offered, both A and B get nothing. The dictator and ultimatum games hold important lessons for issues such as charitable giving and philanthropy.

Peace-War

This is a variation of the prisoner’s dilemma in which the “cooperate or defect” decisions are replaced by “peace or war.” An analogy could be two companies engaged in a price war. If both refrain from price cutting, they enjoy relative prosperity (cell a), but a price war would reduce payoffs dramatically (cell d). However, if A engages in price-cutting (i.e., "war") but B does not, A would have a higher payoff of 4 since it may be able to capture substantial market share, and this higher volume would offset lower product prices.

Peace-War Payoff Matrix Company BCompany BPeaceWarCompany APeace(a) 3, 3(b) 0, 4 War(c) 4, 0(d) 1, 1Volunteer’s Dilemma

In a volunteer’s dilemma, someone has to undertake a chore or job for the common good. The worst possible outcome is realized if nobody volunteers. For example, consider a company where accounting fraud is rampant but top management is unaware of it. Some junior employees in the accounting department are aware of the fraud but hesitate to tell top management because it would result in the employees involved in the fraud being fired and most likely prosecuted.

Being labeled as a whistleblower may also have some repercussions down the line. But if nobody volunteers, the large-scale fraud may result in the company’s eventual bankruptcy and the loss of everyone’s jobs.

Frequently Asked Questions

What are the 'games' being played in game theory?

It is called game theory since the theory tries to understand the strategic actions of two or more "players" in a given situation containing set rules and outcomes. While used in a number of disciplines, game theory is most notably used as a tool within the study of business and economics. The "games" may thus involve how two competitor firms will react to price cuts by the other, if a firm should acquire another, or how traders in a stock market may react to price changes. In theoretic terms, these games may be categorized as similar to prisoner's dilemmas, the dictator game, the hawk-and-dove, and battle of the sexes, among several other variations.

What does the prisoner's dilemma teach us?

The prisoner’s dilemma shows that simple cooperation is not always in one’s best interests. In fact, when shopping for a big-ticket item such as a car, bargaining is the preferred course of action from the consumers' point of view. Otherwise, the car dealership may adopt a policy of inflexibility in price negotiations, maximizing its profits but resulting in consumers overpaying for their vehicles. Understanding the relative payoffs of cooperating versus defecting may stimulate you to engage in significant price negotiations before you make a big purchase.

What is a Nash Equilibrium in game theory?

Nash equilibrium in game theory is a situation in which a player will continue with their chosen strategy, having no incentive to deviate from it, after taking into consideration the opponent's strategy.

How can businesses use game theory as they compete with one another?

Cournot competition, for example, is an economic model describing an industry structure in which rival companies offering an identical product compete on the amount of output they produce, independently and at the same time. It is effectively a prisoner's dilemma game.

The Bottom Line

Game theory can be used very effectively as a tool for decision-making whether in an adversarial, business, or personal setting.

Compare Accounts

×

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.